The Central Bureau of Investigation (CBI) has filed a chargesheet against former CEO of ICICI Bank, Chanda Kochhar, and Videocon Group promoter, Venugopal Dhoot, in a case related to alleged irregularities in the sanction of loans worth Rs. 1,875 crores by ICICI Bank to Videocon Group companies between 2009 and 2011. The chargesheet was filed in a special court in Mumbai under various sections of the Indian Penal Code (IPC) and the Prevention of Corruption Act (PCA).

Background

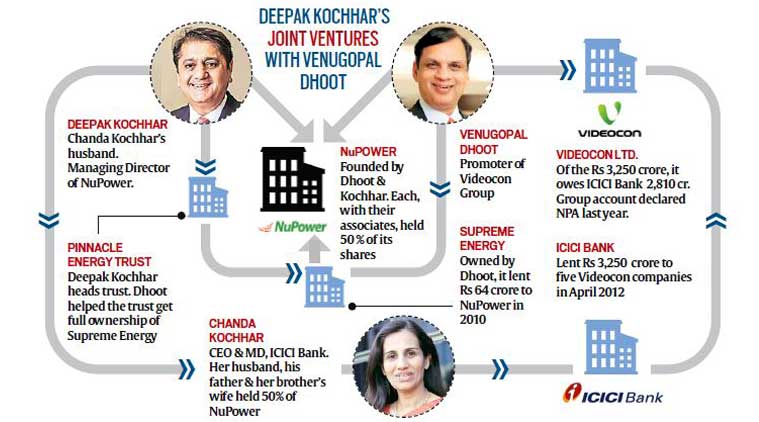

The case dates back to 2018 when allegations of conflict of interest were first raised against Chanda Kochhar for her alleged role in the sanction of loans to Videocon Group companies while her husband, Deepak Kochhar, had business dealings with the Videocon Group. ICICI Bank had initially cleared Kochhar of any wrongdoing, but after an independent enquiry by retired Supreme Court judge B.N. Srikrishna, it terminated her services and clawed back bonuses and stock options worth millions of rupees.

The CBI had registered a case against Chanda Kochhar, Deepak Kochhar, and Venugopal Dhoot in January 2019 and conducted raids at their premises. The Enforcement Directorate (ED) and the Income Tax Department had also initiated separate investigations into the case.

Also read: RBI Keeps Repo Rate Unchanged at 6.5%

Chargesheet details

The chargesheet filed by the CBI names Chanda Kochhar, Deepak Kochhar, and Venugopal Dhoot as accused, along with two companies linked to the Kochhar and Dhoot families. The chargesheet alleges that the loans were sanctioned by ICICI Bank in violation of its own policies and that Chanda Kochhar, as head of the bank, had shown undue favor to Videocon Group companies in return for personal benefits to her husband.

The chargesheet also alleges that Dhoot had invested Rs. 64 crore in NuPower Renewables, a company owned by Deepak Kochhar, through a series of complex transactions involving shell companies based in Mauritius and the UAE, and that this was quid pro quo for the loans sanctioned by ICICI Bank to Videocon Group companies.

Implications

The chargesheet by the CBI is a significant development in the case and could lead to a trial and possible conviction of the accused. It also highlights the need for stricter regulations and oversight in the banking sector to prevent conflicts of interest and fraudulent practices.

The case has already had a negative impact on ICICI Bank’s reputation and financial performance, with the bank’s stock price falling sharply and several senior executives resigning or being replaced. The case has also raised questions about the effectiveness of corporate governance and regulatory mechanisms in India.

Conclusion

The chargesheet filed by the CBI against Chanda Kochhar and Venugopal Dhoot in the loan case involving ICICI Bank and Videocon Group companies is a serious allegation of corruption and conflict of interest. The case highlights the need for greater transparency, accountability, and integrity in the banking sector, and underscores the importance of effective regulation and enforcement in preventing financial fraud and malpractice.

Source: The Times of India